(Image – NewsClick)

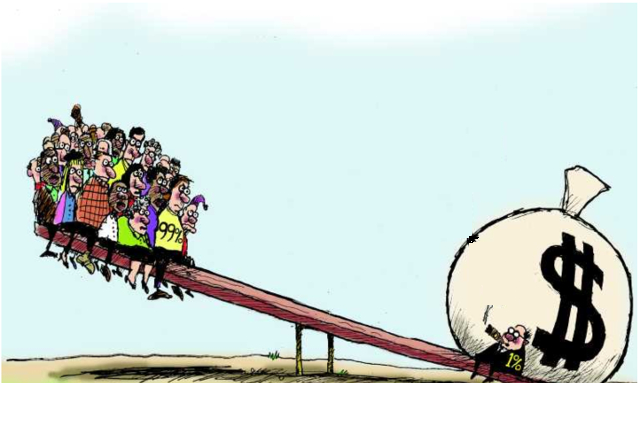

India, a burgeoning economic powerhouse, has made significant strides in recent decades, fueling optimism for a brighter future. However, beneath the surface of progress lies a deep-seated issue: financial inequality. The latest report from the World Iniquity Lab paints a stark picture, revealing that nearly 40% of the country’s wealth is concentrated in the hands of the wealthiest individual, with their share of national income hovering around 22%. This alarming revelation not only underscores the widening chasm between the rich and the poor but also raises concerns about the emergence of plutocracy—a system where economic power is wielded by a select few. In this article, we delve into the root causes, consequences, and potential solutions to India’s growing financial imbalance.

Understanding the Financial Imbalance:

India’s economic trajectory over the past nine years has been characterized by impressive growth and development. However, this progress has been marred by persistent financial inequality, with wealth increasingly concentrated among a privileged minority. The phenomenon of “Plutocracy” looms large, threatening to undermine the principles of democracy and social justice.

Factors Driving Financial Imbalance:

- Economic Policies: The liberalization reforms of the early 1990s heralded a new era of economic growth in India. However, the benefits of this growth have been unevenly distributed, with policies favoring deregulation, privatization, and foreign investment often exacerbating inequality. Moreover, lax enforcement of regulations and loopholes in the tax system have allowed the wealthy to amass fortunes while evading their fair share of contributions to society.

- Technological Disruption: The rise of technology has revolutionized various sectors of the Indian economy, creating unprecedented wealth for those at the forefront of innovation. However, this digital divide has widened the gap between the haves and the have-nots, leaving large segments of the population marginalized and excluded from the benefits of technological advancement.

- Globalization: While globalization has brought opportunities for trade and investment, it has also exposed India to the vagaries of the global economy. The country’s integration into the global market has led to a concentration of wealth in industries such as finance, technology, and real estate, further exacerbating financial inequality.

Consequences of Financial Imbalance:

The consequences of India’s financial imbalance are far-reaching and multifaceted, permeating various aspects of society and the economy:

- Social Cohesion: Financial inequality erodes social cohesion and exacerbates tensions between different segments of society. The widening wealth gap fosters resentment and disillusionment among the disenfranchised, leading to social unrest and instability.

- Economic Growth: While economic inequality can fuel growth in the short term by incentivizing innovation and entrepreneurship, excessive inequality can have detrimental effects on long-term economic stability and sustainability. A concentration of wealth in the hands of a few stifles consumer demand, limits investment opportunities, and hampers inclusive growth.

- Political Stability: The concentration of economic power in the hands of a wealthy elite poses a threat to democratic institutions and political stability. In a plutocratic system, the interests of the rich often take precedence over the needs of the general populace, undermining the principles of democracy and equality.

Addressing the Financial Imbalance:

Tackling India’s financial imbalance requires a comprehensive and multi-pronged approach that addresses the root causes of inequality while promoting inclusive and sustainable development:

- Progressive Taxation: Implementing progressive taxation measures to ensure that the burden of taxation is distributed equitably based on individuals’ ability to pay. This includes closing loopholes, cracking down on tax evasion, and introducing wealth taxes on the ultra-rich.

- Social Welfare Programs: Strengthening social welfare programs to provide essential services such as education, healthcare, and housing to marginalized communities. Investing in human capital development is crucial for reducing poverty and inequality and promoting social mobility.

- Economic Reforms: Implementing reforms to promote inclusive growth and create opportunities for all segments of society. This includes investing in infrastructure, improving access to credit and financial services, and fostering entrepreneurship and innovation in underserved regions.

- Regulatory Oversight: Strengthening regulatory oversight to curb monopolistic practices, corporate malfeasance, and illicit financial activities. Enhancing transparency and accountability in governance mechanisms is essential for restoring public trust and promoting ethical business practices.

- Empowering Civil Society: Fostering civil society engagement and activism to hold policymakers and corporations accountable for their actions. Grassroots movements and advocacy efforts play a crucial role in raising awareness about financial inequality and advocating for policy reforms that benefit the common good.

The specter of financial imbalance looms large over India’s economic landscape, posing a significant challenge to the country’s aspirations for inclusive and sustainable development. Addressing this issue requires a concerted effort from policymakers, civil society, and stakeholders across sectors to enact meaningful reforms that promote social justice, equality, and shared prosperity. By tackling the root causes of inequality and fostering an environment of inclusive growth, India can realize its full potential as a vibrant and dynamic democracy where the benefits of economic progress are enjoyed by all.

(Disclaimer: The content of this article is entirely based on the information collected from some Analytical sources and other trusted sources. The author doesn’t have responsibility for any incorrect or imposed information.)